[ad_1]

On this weblog submit, I believed I might study this query above, which is among the extra widespread questions I hear world traders ask concerning the Vietnam inventory market.

IS VIETNAM A FRONTIER OR AN EMERGING MARKET?

This isn’t a brand new query. For instance I bear in mind studying loads of tales virtually 5 years in the past on this matter. Many had been speculating that by the yr 2020 Vietnam would possibly already be upgraded to rising market inventory market standing by the likes of world indices suppliers comparable to MSCI and FTSE.

To set the document straight although as we converse at the moment, Vietnam is taken into account a frontier inventory market.

When writing about whether or not it’s acceptable to guage Vietnam as a frontier or rising inventory market, it’s helpful to contemplate a few of the key elements the worldwide funding group seems to be at when making such judgments.

Within the subsequent couple of subheadings, I shall break it all the way down to elements that firstly could make others contemplate it extra of a frontier inventory market. The second subheading will focus on the elements that will happen over the following years that see it upgraded to an rising inventory market.

IS VIETNAM A FRONTIER MARKET?

A frontier inventory market would possibly are inclined to exhibit the next traits (Trying again traditionally this may increasingly have included Vietnam a decade or so in the past, however issues are altering and now Vietnam is quickly transferring away from such traits):

- Low market cap of the market in comparison with rising inventory market counterparts.

- Illiquid buying and selling volumes.

- Weak company governance.

- Problem for overseas traders to entry whether or not that be as a result of exclusions or different logistical limitations.

- Political instability.

- Unclear funding legal guidelines, lack of regulation, substandard monetary reporting and so on.

IS VIETNAM AN EMERGING MARKET?

Listed below are key elements to watch this yr and the years forward to lookout if an improve to rising market standing is imminent for Vietnam:

- Higher developed and clear legal guidelines on funding and the securities business.

- Enhancements in general inventory market IT infrastructure to allow instruments comparable to quick promoting, derivatives and so on.

- Inventory trade IT enhancements to assist with growing volumes on the whole, giant and environment friendly settlements and so on.

- Extra flexibility within the FOREX market.

- Extra corporations to supply bilingual reporting to traders.

- Additional consolidation of the pattern of elevated liquidity of the market on the whole.

- Additional consolidation of the pattern in the direction of easing of overseas investor limits.

- A transfer from FTSE first, placing some stress on MSCI to comply with?

WHEN WILL THE VIETNAM STOCK MARKET GET UPGRADED TO EMERGING MARKET STATUS?

Currently I got here throughout a narrative on the subject, one which acknowledged the Vietnam inventory market may need to attend till 2025 to be upgraded to rising market standing. That could possibly be seen as disappointing to those who learn articles round 2018 stating an improve may happen round 2020!

Maybe the pandemic was a blow to anticipating all this to progress too shortly. Anyway, the Vietnam inventory market continues to be heading in the right direction. There’s proof of enhancements and steps being taken for it to fill lots of the standards I simply talked about above that world traders are searching for.

We could solely be a few years away from this large change. Some recommend FTSE may even act on this a lot faster than that.

WHAT DOES AN UPGRADE TO EMERGING MARKET STATUS MEAN TO THE VIETNAM STOCK MARKET?

The pool of potential traders for rising market inventory publicity is way better than that that are keen to spend money on frontier inventory markets. Many on this pool have embraced the concept of utilizing ETFs based mostly on well-known market indices suppliers to acquire such exposures.

Due to this fact ought to the Vietnam inventory market be upgraded to rising market standing we should always see some main new supply of world inflows, a possible large optimistic catalyst for the inventory market.

I can now hear readers assume to themselves, effectively this needs to be a comparatively understood possible occasion sooner or later, wouldn’t it already be priced in?

Probably.

Nonetheless I might observe that lately the pattern of massive inflows from world traders has been slightly absent. It is a very totally different pattern to the recent cash that poured into the Vietnam inventory market from offshore traders within the earlier large increase round 2007.

I might additionally level out that ought to the Vietnam inventory market achieve inclusion within the rising inventory market indices, it will likely be a outstanding element. That’s as a result of it’s fairly important by way of its general market cap.

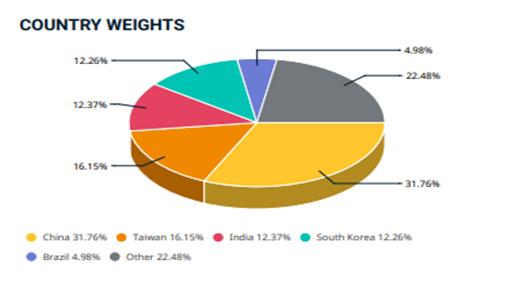

For some info, under is a current snapshot of who makes up the present MSCI rising inventory market index:

Supply: msci.com (knowledge Feb 28, 2022)

With respecting the speculation that markets are typically pretty environment friendly, I nonetheless consider {that a} future improve to Vietnam to rising inventory market standing can act as a tailwind to costs going ahead.

Though we’d have to attend even till 2025 in accordance with some to get such an improve from MSCI, the market would possibly begin to reply positively a lot earlier to snippets of stories that comes out on this matter. This would possibly happen at the same time as earlier as this yr.

ARE EMERGING STOCK MARKETS CHEAP IN 2022?

Late final yr I mentioned the talk on how rising inventory market valuations stacked up versus developed markets. You’ll be able to learn on my ideas through the under hyperlink:

PROBLEMS WITH REOPENING STOCKS, EMERGING VS DEVELOPED MARKETS OUTLOOK 2022. – VIETNAM STOCK MARKET (vietnamesestockmarket.com)

SHOULD I INVEST IN THE VIETNAM STOCK MARKET IN 2022?

Let me know within the feedback space in case you assume now could be the time to get set in Vietnam shares to realize publicity to this potential optimistic catalyst? Or maybe it’s far too early given some recommend this improve may nonetheless be a couple of years away?

Is Vietnam a great funding?

To remain up to date on my journey on exploring the best way to finest spend money on the Vietnam inventory market, please be happy to enter your e mail deal with within the subscriber space under to be notified of posts I make. (I cannot spam your inbox, anticipate maybe often one related weekly replace).

Thanks!

[ad_2]

Source link