[ad_1]

pawel.gaul/iStock by way of Getty Photographs

(This text was co-produced with Hoya Capital Actual Property)

Introduction

I’m of the age the place I needed to register for the Vietnam Battle and get my draft quantity. The peace treaty was signed earlier than I graduated from highschool, so I prevented getting drafted. Two years later, Saigon was conquered and renamed in honor of Ho Chi Minh, the North Vietnamese chief relationship again to WWII. As a dedicated communist, one has to surprise what he thinks of getting a capitalist inventory trade within the metropolis title after him?

How issues change! The MSCI Vietnam Index was launched on Dec 18, 2007, they usually turned a part of the bigger MSCI Frontier Index on the similar time. Frontier nations are those with lively markets however do not meet MSCI’s necessities to be categorised as Rising. At the moment, there are 21 nations within the Frontier Markets Index, 4 of that are in Asia. Vietnam is the one one in Far East Asia.

A take a look at Vietnam

Vietnam, or the Socialist Republic of Vietnam, is situated on the japanese fringe of mainland Southeast Asia, was formally established after the top of the Vietnam Battle. It covers 128,000 sq. miles; with a inhabitants of over 96 million, making it’s the world’s fifteenth most populous nation. Its capital is Hanoi and its largest metropolis is Ho Chi Minh Metropolis.

Primarily based on Buying Energy Parity, or PPP, Vietnam ranks 116 on the planet, simply behind Jamaica and forward of the Philippines. That is up from one hundred and thirtieth ten years in the past. On the financial freedom scale, whereas their rating is enhancing, Vietnam ranks 62nd, the identical as Russia and Belarus. I included that to say the particular dangers when investing in a Communist nation with a closely managed financial system.

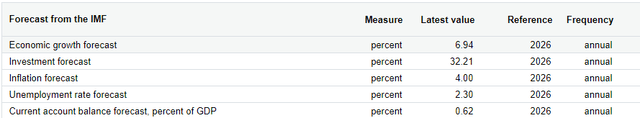

Some important financial forecasts from the Worldwide Financial Fund are:

theglobaleconomy.com Vietnam

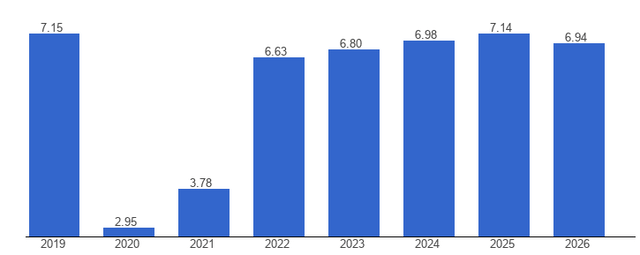

With a projected GDP development charge in 2026 is 6.94%, Vietnam ranks third on the planet for that yr. The world common for 2026 is 3.38%. Vietnam’s common development charge from 1980-2026 is projected to be 6.37%.

theglobaleconomy.com Vietnam

The Funding forecast (32.21%) locations them twenty fourth on the record. Their 4% inflation charge is about double what’s forecasted for the USA.

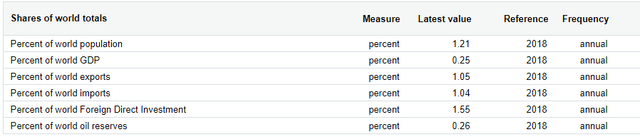

theglobaleconomy.com Vietnam

Primarily based on exports and imports, they’re 4X their world GDP weight, and barely beneath their p.c of the world’s inhabitants.

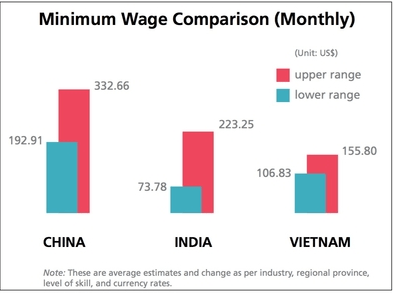

One motive some analysts like Vietnam, because it might be a producing diversification possibility away from China. Secondly, as the price of doing enterprise reduces the explanation for being in China, Vietnam’s decrease value beneficial properties attractiveness.

gpminstitute.com/publications-resources/International-Payroll-Journal

Because of their measurement, China or India, quantity and useful resource smart, have benefits over Vietnam, however wages at the moment favor the later. Even in comparison with their closest neighbors, Cambodia and Thailand, Vietnam’s labor prices are decrease. Whether or not productiveness offsets any of those comparisons, I couldn’t discover knowledge to reply that query.

Exploring the VanEck Vectors Vietnam ETF

Searching for Alpha describes this ETF as:

VanEck Vectors Vietnam ETF is an trade traded fund launched and managed by Van Eck Associates Company. It invests in public fairness markets of Vietnam. It invests in shares of corporations working throughout diversified sectors. The fund invests in development and worth shares of corporations throughout diversified market capitalization. The fund seeks to trace the efficiency of the MVIS Vietnam Index. VNM began in 2009.

Supply: seekingalpha.com VNM

VNM has $543m in property and offers traders with a minimal yield of .52%. VanEck prices 61bps in charges; quite common for Frontier Market funds.

Analyzing the Index

An preliminary due diligence step for any fund that invests based mostly on an index is knowing that index. The VNM ETF makes use of the MVIS Vietnam Index, which the supplier, MV Index Options, describes as:

The MVIS Vietnam Index (MVVNM) tracks the efficiency of the most important and most liquid corporations integrated in Vietnam. The index additionally contains non-local corporations integrated exterior Vietnam that generate no less than 50% of their revenues in Vietnam. MVVNM covers no less than 90% of the investable universe.

Supply: mvis-indices.com Vietnam

Among the inclusion/building guidelines for the Index are:

- The Index contains 50 corporations, 14 of which qualify based mostly on the 50% income rule.

- Market-cap of no less than $150m USD.

- A minimum of 250,000 shares traded per thirty days over the past six months at a evaluation and in addition on the earlier two critiques. There are quarterly critiques.

- Firm weightings are capped at 8%.

- Particular choice guidelines come into play if different {qualifications} drop the Index parts beneath 25 shares.

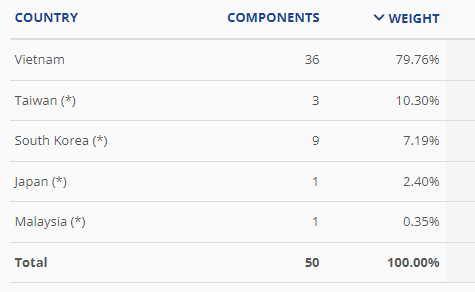

The present nation make-up of the Index is subsequent; so at the moment about 20% of the load includes shares not headquartered in Vietnam.

mvis-indices.com/indices/nation

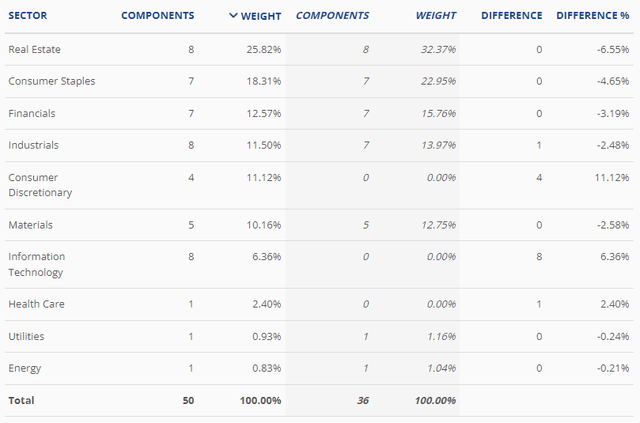

As a result of the Index permits non-Vietnamese corporations to be included, they supply two weighting charts that present sector allocations. Discover 100% of three sectors are non-home corporations, together with the Tech sector.

mvis-indices.com/indices/sectors

VNM Holdings evaluation

mvis-indices.com Vietnam

I believe that many of the bigger corporations held are non-home shares. Index-based funds are given permissions to “drift” from the Index. The most typical allowance is 20% exterior the index or away from its sector weightings. The above knowledge wasn’t dated, so a number of the weight variations might be as a result of sources not matching date-wise.

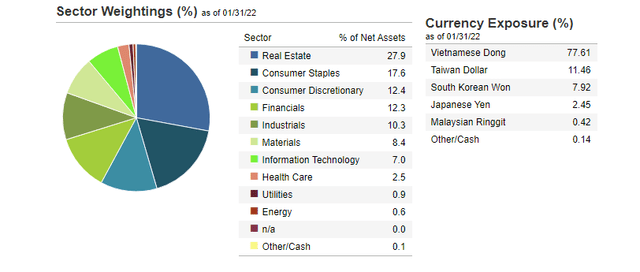

vaneck.com VNM

There’s forex publicity to proudly owning this ETF, as proven within the right-side desk above, largely towards the Vietnamese Dong after which the Taiwan Greenback. In reviewing the ETF’s paperwork, I didn’t see something that indicated the ETF tries to hedge any of their forex publicity.

High Holdings

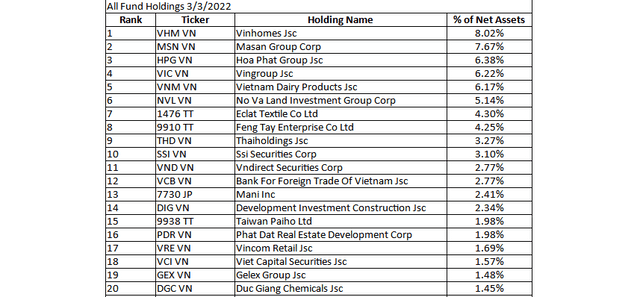

vaneck.com; compiled by Writer

The High 10 comprise 55% of the property; the High, 20 75%. As with different VanEck ETFs, VNM is allowed to take part in safety lending. Primarily based on the Index guidelines, a number of the high holding, Vinhomes, may should be bought as it’s above the 8% cap. On the finish of the yr, about 2% of the property have been being lent out, with VNM incomes a median of 1.44% on that exercise.

I discovered some descriptions of the High 5 holdings.

Vinhomes is the No.1 actual property growth and administration firm in Vietnam, acknowledged for its superior scale, execution pace and repair high quality, main the market to sustainable development, with the imaginative and prescient of changing into a world-class enterprise.

Mason Group is a holding firm with controlling financial pursuits in The CrownX, Masan MEATLife (“MML”) and Masan Excessive-Tech Supplies (“MSR”), representing an financial curiosity of 84.93%, 78.74% and 86.39% respectively, as of 30 June 2021. The CrownX is Masan’s built-in client retail arm that consolidates its pursuits in Masan Shopper Holdings and VCM Companies and Buying and selling Growth JSC.

Hoa Phat is the main industrial manufacturing group in Vietnam. At the moment, the Group operates in 05 sectors: Iron and metal (building metal, sizzling rolled coil) – Metal merchandise (together with metal pipes, galvanized metal, drawn metal wire, prestressed metal) – Agriculture – Actual property – House home equipment. Metal manufacturing is the core, accounting for 90% income and revenue of the Group.

Vingroup continues to pioneer and lead client developments in every of its companies introducing Vietnamese customers to a model new, trendy life-style with international-standard services and products. Vingroup has created a revered, well-recognized Vietnamese model and is proud to be one of many nation’s main personal enterprises. They’ve three methods: Know-how & Trade, Commerce & Companies, and Social Enterprise.

Vietnam Dairy Merchandise JSC is a Vietnam-based firm engaged within the meals processing trade, particularly, the dairy trade. It’s concerned within the manufacturing, advertising, wholesale buying and selling, and retailing.

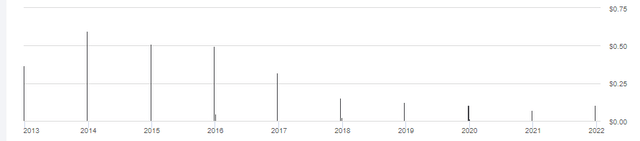

VNM Distribution evaluation

seekingalpha.com DVDs

12 months-end is the norm for payout, typically with slightly additional, however total traders might want to search for worth appreciation to get any significant return from this ETF.

Portfolio technique

If an investor was attempting to be GDP-weighted (.25%) of their fairness allocation, the VanEck Vectors Vietnam ETF is the one ETF I’m conscious of that’s single-focused on this nation. There’s a second ETF traders can contemplate that has a 30% publicity to Vietnam. It’s the iShares MSCI Frontier and Choose EM ETF (FM), which I reviewed lately right here.

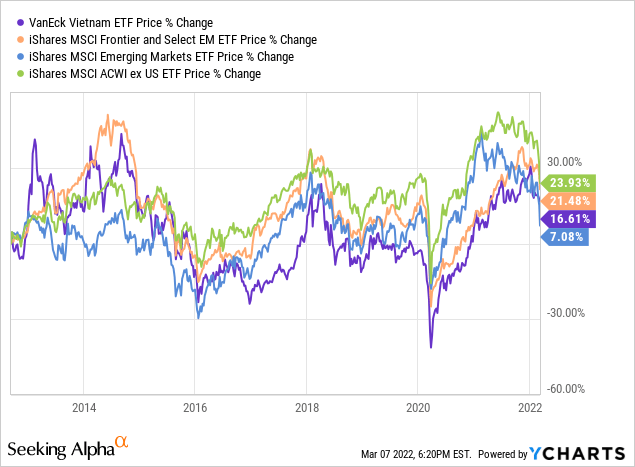

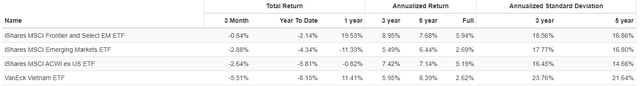

Since 2012, the VNM ETF has trailed these consultant worldwide ETFs. The following chart exhibits efficiency over set durations, together with tier StdDevs, which VNM has the very best.

www.portfoliovisualizer.com

Whereas the present world occasions make any funding extra harmful, if the specialists are right, Vietnam ought to do effectively, however its efficiency solely charges a Maintain at the moment.

[ad_2]

Source link