[ad_1]

International buyers who search publicity to the Vietnam inventory market typically achieve this by way of ETFs or Closed Finish Funds (CEFs) that maintain the bigger and extra liquid firms. Such firms are normally outstanding constituents on numerous Vietnam inventory indices such because the VN-Index, FTSE Vietnam Index, MSCI Vietnam Index and so on.

On this weblog put up I shall focus on one such massive Vietnam inventory, the Airports Company of Vietnam (UPCOM:ACV). I believed is perhaps helpful to usually present a broad overview of the shares you would possibly see pop up in fund supervisor holdings. The aim is to not present purchase or promote suggestions. Nonetheless a fast abstract of key drivers for future efficiency would be the goal, and readers could make their very own thoughts up of whether or not Airports Company of Vietnam is an efficient inventory to purchase?

WHY AIRPORTS CORORATION OF VIETNAM?

Airports Company of Vietnam is perhaps a great inventory for many who need to choose up an funding that also trades beneath the share worth seen some 4 years in the past. If proudly owning this, you’ll be searching for a contrarian sort play on the hope of elevated journey quickly.

When labelling it’s a contrarian play, I ought to level out that we noticed less expensive ranges throughout this pandemic such because the Delta surge in mid-2021, and extra lately the scares round Omicron. Having mentioned that, it is probably not too late to get on board. I’ve seen some good fund managers have it as a robust conviction choose nonetheless, and the ahead earnings multiples look engaging.

AN OVERVIEW OF THE AIRPORTS CORPORATION OF VIETNAM (UPCOM:ACV)

Three key income sources.

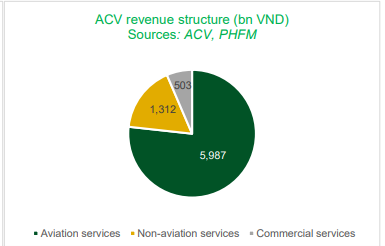

Airports Company of Vietnam manages 22 airports throughout the nation. The three foremost segments include Aviation providers which contributed greater than three quarters of their income in 2020, then there are non-aviation providers, and a lesser extent from business providers.

Aviation providers

We are able to merely take into consideration what’s required to providers ourselves on a visit by way of an airport. We..

– verify in our baggage

– undergo airport screening

– use all of the services wanted in taking off and touchdown safely on the runway

– require parking and/ or bus journey providers inside the airport

Above isn’t a whole record but it surely illustrates that these providers will not be supplied at no cost so consider ACV because the one clipping the ticket in Vietnam.

Non-Aviation providers

ACV picks up a a lot smaller proportion of income from non-aviation providers comparable to making use of its general terminal area capability. Land leasing may be beneficial and different companies might discover their services helpful for workplace rental or promoting or different miscellaneous makes use of.

Business providers

This refers to loads of the shops you see at numerous airports and makes up a small fraction of ACVs revenues general. Consider shops whether or not or not it’s souvenirs or meals & beverage retailers, ACV can generate earnings from managing such shops themselves.

FACTORS TO DECIDE ON WILL AIRPORTS CORPORATION OF VIETNAM (UPCOM:ACV) SHARES WILL CONTINUE TO RISE IN 2022?

Current reopening of Vietnam’s worldwide air site visitors – As quickly as 2022 started worldwide air site visitors was “reopened”. I exploit the phrase loosely as a result of initially it began with solely sure routes with caps in place. As I’ve additionally mentioned on the weblog lately, January this 12 months was nonetheless comparatively closed for a lot of travellers when it comes to issuance of visas and different logistics round acquiring flights briefly provide and negotiating quarantine necessities and so on.

The inventory might be delicate to such roadblocks to travelling being correctly lifted. Information has been promising of late on this entrance; nevertheless warning stays as we’ve got run into loads of left discipline issues within the final two years!

For instance, after I say the information has been promising of late, blended in with such information is you hear generally that tourism will open with numerous hassles / restrictions on vacationers. So information stream may be fickle as I write this in early March!

Vietnam’s excessive vaccination charge ought to hopefully give worldwide travellers some extra confidence.

Confidence of home air journey inside Vietnam – Issues have been extra “free” journey clever when it comes to home air journey this 12 months. On the bottom right here it seems like life is getting extra regular in dwelling with the virus. Vietnam continues to be nevertheless coping with an Omicron spike later than many components of the world. If the expertise elsewhere on the planet is any information, this needs to be extra within the rear vison mirror by the month of Could as case numbers ought to head down.

Infrastructure alternative and HCMC inventory alternate itemizing – You may need seen on this put up the inventory ticker I indicated right here displays that ACV isn’t but listed on the HCMC inventory alternate like different massive cap Vietnam shares.

With out getting too slowed down into the complexities of the ACV stability sheet / accounting reporting necessities and so on, it’s technical when it comes to its construction getting used with the state capital asset and in addition the way it can develop aviation infrastructure belongings. Suffice to say that some analysts consider a extra streamlined construction involving a HOSE itemizing is a constructive catalyst for the inventory going ahead that may assist with future financing preparations.

One main infrastructure challenge for instance is the Lengthy Thanh Worldwide Airport, the second close to HCMC. Particularly will probably be positioned about 40km from HCMC. It’s a enormous challenge and nonetheless in all probability greater than 5 years away. ACV might want to ramp up its functionality to fund on account of this quickly and therefore my feedback simply above.

Price controls – Administration had been perceived as doing a great job because the pandemic took maintain with this firm. Clearly the sort of enterprise was entrance and centre to all of it, and so they responded prudently with value management measures. Analysts might be monitoring intently how they preserve prices in verify as journey hopefully improves particularly within the again half of 2022.

AIRPORTS CORPORATION OF VIETNAM VALUATIONS – AIRPORTS CORPORATION OF VIETNAM PE RATIO, YIELD ETC.

Airports Company of Vietnam PE Ratio – 25 occasions (2022 forecasted)

Airports Company of Vietnam dividend yield – n/a

AIRPORTS CORPORATION OF VIETNAM SIZE IN TERMS OF VIETNAM STOCK INDEX AND COMPONENTS

Airports Company of Vietnam on the time of writing is in regards to the seventh largest firm of my searches of Vietnam inventory record of the most important firms. The market cap in USD is circa $9 billion.

IS AIRPORTS CORPORATION OF VIETNAM A GOOD UNDERVALUED VIETNAMESE STOCK TO BUY FOR 2022?

At an preliminary look the forecast P/E of circa 25 occasions for the inventory for 2022 earnings might look dear to some. We should keep in mind although that this 12 months, the “E” within the equation continues to be prone to be a depressed earnings 12 months relative to any future anticipated earnings determine.

The inventory did begin 2022 pretty properly worth clever, nevertheless maybe buyers nonetheless haven’t essentially missed the boat to get aboard. In hindsight a purchase order just a few months again may need labored properly, nevertheless now we take pleasure in at the least seeing extra concrete indicators that Vietnam is certainly opening as much as worldwide journey. We are able to additionally observe many different components of the world dwelling with covid to a larger extent, in comparison with late final 12 months when the Omicron pressure created extra uncertainty.

On the time of scripting this in early March, I believe the inventory from across the 90,000 degree can nonetheless do fairly properly over the long run. Relative to different comparable sort of shares throughout Asia, the ahead incomes multiples right here look cheaper with ACV. On a worth to ebook foundation, it is also cheaper than friends. That is necessary to notice as despite the fact that that’s the case, I’ve seen analysts level out that the stability sheet could also be undervaluing its asset base to a point.

I’ve seen in latest occasions that two fund managers I charge extremely in Vietnam, the Pyn Elite Fund and the Vina Capital Alternative Fund, have touted it as a probable outperformer in 2022. Once I final checked these two funds have made it a robust wager of their concentrated portfolio investing approaches.

OTHER VIETNAM STOCK INDEX COMPONENTS REVIEWS

In case you are desirous about comparable summaries and evaluation on different bigger Vietnam listed shares listed here are another hyperlinks to take a look at.

VIETNAM STOCK INDEX COMPONENTS REVIEW – VINAMILK (HOSE:VNM) – VIETNAM STOCK MARKET (vietnamesestockmarket.com)

VIETNAM STOCK INDEX COMPONENTS REVIEW – VINHOMES (HOSE:VHM) – VIETNAM STOCK MARKET (vietnamesestockmarket.com)

Is Vietnam a great funding?

To remain up to date on my journey on exploring methods to greatest put money into the Vietnam inventory market, please be happy to enter your e-mail deal with within the subscriber space beneath to be notified of posts I make. (I cannot spam your inbox, count on maybe normally one related weekly replace).

Thanks!

[ad_2]

Source link