[ad_1]

The Terra Protocol is a blockchain protocol that makes use of algorithmic stablecoins to energy price-stable world funds techniques. The Terra blockchain helps an ecosystem for customers to mint, handle, trade, and commerce Terra stablecoins that may be tied to any fiat.

Terra seeks to stabilize the worldwide funds techniques by combining the value stability of fiat currencies with the control-free and censorship-resistant blockchain expertise.

The Terra protocol consists of two cryptocurrencies: Terra and LUNA.

Learn on for our deep dive into the Terra blockchain community and Terra’s native token, Luna, and discover ways to purchase Terra Luna cryptocurrency in just a few easy steps.

Now let’s get began!

What Is Terra Luna

Terra is an open-source blockchain platform for algorithmic stablecoins which are pegged in opposition to conventional fiat. The algorithmic stablecoins created on the Terra protocol persistently observe the value of any fiat foreign money. Whereas most stablecoins are pegged to the US greenback, Terra additionally has stablecoins pegged to many different currencies, together with the Euro and the TerraKRW (KRT) pegged to the South Korean received, together with the TerraUSD (UST) pegged to the US greenback.

The Terra blockchain permits customers to commerce Terra stablecoins immediately on its platform and gives help for stablecoin builders to construct Terra DeFi tasks.

The challenge consists of two cryptocurrencies: Terra and LUNA. TERRA is the stablecoin that tracks the value of fiat currencies and is known as after them, i.e., TerraKRW (KRT), TerraUSD (UST), and so on. Customers mint Terra by burning LUNA. LUNA is the community’s native token, its staking and governance token, used to stabilize the value of the protocol’s stablecoins.

Not like most DeFi protocols that run on the Ethereum Community, Terra runs on the Cosmos Blockchain. This offers an enormous benefit to Terra over different DeFi tasks because the transaction time and fuel charges are fairly negligible for it in comparison with those working on the Ethereum Community. Nevertheless, the downside is that since Terra just isn’t on Ethereum, its person base nonetheless has to develop. The Terra stablecoin platform makes use of the Proof of Stake (PoS) mechanism.

Terraform Labs is the corporate behind Terra, based in January 2018 by Daniel Shin and Do Kwon.

How Does Terra Luna Work

The Terra ecosystem is constructed with Tendermint, and the Proof-of-Stake mechanism retains the Terra community secured.

The native Terra community token is Luna with the ticker LUNA. The Luna token is used to problem Terra stablecoins (TerraSDRs). It really works as a worth stability mechanism on the platform and may also be used for staking and incomes rewards. The Terra Luna token holders are granted governance rights and voting energy for the protocol.

The community gives Terra stablecoins pegged to U.S. Greenback, South Korean Gained, Mongolian Tugrik, and the foreign money basket within the Worldwide Financial Fund’s Particular Drawing Rights(SDRs), with plans to incorporate extra fiat foreign money pegged stablecoins sooner or later. The Terra stablecoin goals to steadiness stability by making a cryptocurrency with a versatile financial coverage managed by a Treasury. To maintain the worth of Terra secure, the Terra algorithm mechanically adjusts the availability of stablecoins based mostly on their demand. That is finished by incentivizing the Luna holders to swap Luna and stablecoins relying on whether or not the availability of stablecoins is elevated or decreased. The U.S. greenback stablecoin for Terra is UST and is mutual to Luna. The surplus tokens are burned when the demand for UST stablecoin rises. Because the demand for UST grows, the Luna worth will increase, and if the demand for UST decreases, the Luna worth may also lower.

Luna Tokenomics

There are presently 1 Billion Luna tokens in provide, and new Luna tokens are burnt or minted relying on the demand. The token is used to stabilize the value of the protocol’s stablecoins.

Terra raised $32 million in seed funding. Of the 385,245,974 LUNA minted on the market, 10% was reserved for Terraform Labs, 20% for workers and challenge contributors, 20% for the Terra Alliance, 20% for worth stability reserves, 26% for challenge backers, and 4% for genesis liquidity.

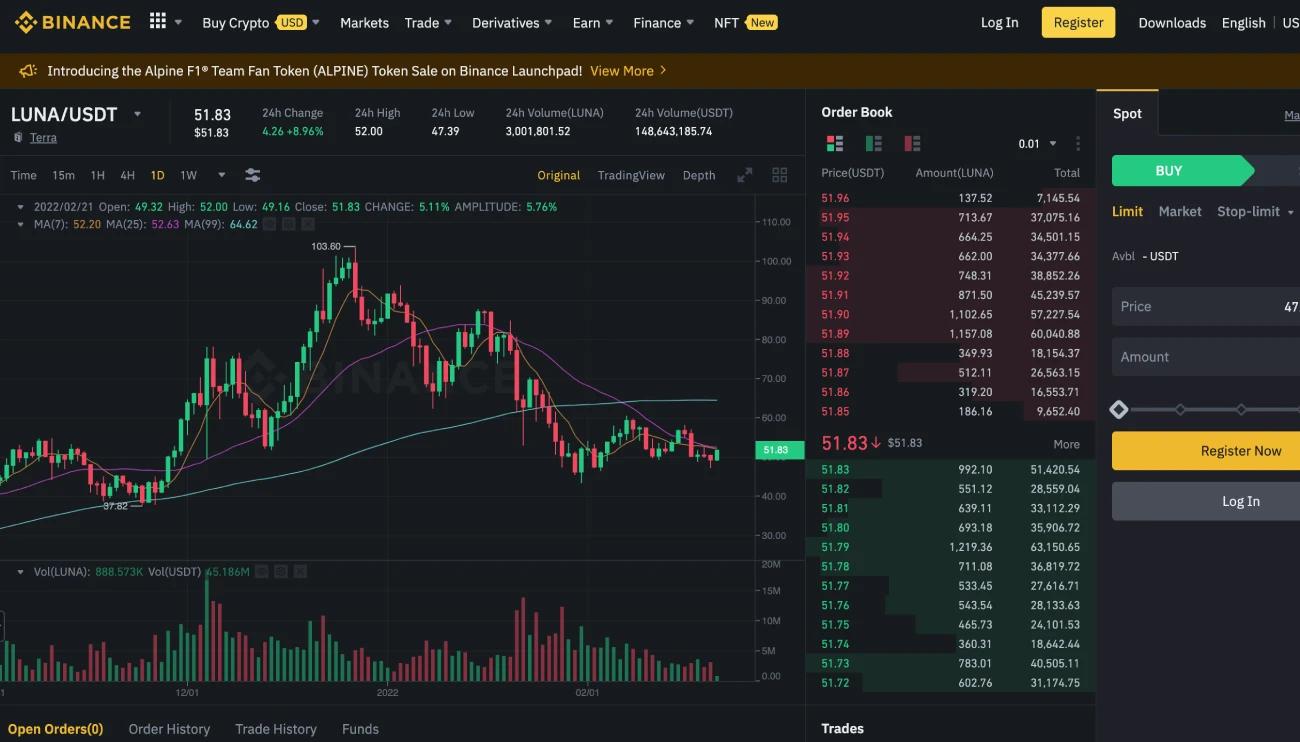

The token’s worth hit an all-time excessive of USD 103.33 on December twenty seventh, 2021. For the reason that worth has dropped by almost 50 % within the final couple of months, this presents a superb alternative to purchase Terra.

The preferred cryptocurrency exchanges for buying and selling Luna tokens are Binance, Kucoin, Huobi International, Bitfinex, and so on., and the most well-liked shopping for pair is LUNA/USDT. It’s also possible to commerce Luna on virtually all main centralized and decentralized crypto exchanges worldwide.

The current market capitalization of the Terra Luna token is USD 22,349,147,751. You may test the present worth of LUNA Terra and extra on CoinStats crypto portfolio tracker, the most effective crypto platforms round.

It’s also possible to study extra concerning the Terra community and the Terra Alliance utilizing Coinmarketcap’s on-line academic useful resource.

Purchase Terra on Binance

Since Binance is the world’s largest cryptocurrency trade in buying and selling quantity, many customers desire to buy Terra(LUNA) on it. Nevertheless, Binance doesn’t enable US buyers, so we advocate you join on different exchanges listed under if you’re from the U.S.

To purchase Luna on Binance, it’s essential to create a retail investor account and bear KYC verification by importing identification proof paperwork. As soon as the account is verified, you should purchase Luna or every other cash of your alternative both by way of fiat foreign money deposits utilizing a credit score or debit card and financial institution switch or by way of one other crypto.

After getting efficiently added funds to your pockets, the subsequent step is to choose the buying and selling pair in opposition to which you want to purchase Terra(LUNA). Main buying and selling pairs are LUNA/USDT, LUNA/BTC, LUNA/BUSD, LUNA/EUR, and so on. To check costs throughout completely different buying and selling pairs, use the comparability service of CoinStats.

Let’s say you choose the LUNA/BTC pair; then, you will want to buy Bitcoin well worth the quantity you need to buy Terra for. When you’ve added the required BTC to your Spot Pockets, you’ll be able to commerce Bitcoin for Terra utilizing the Binance trade. The transaction happens inside seconds, and the tokens ought to mirror in your Spot Pockets.

Purchase Terra on Kucoin

Kucoin ranks among the many prime cryptocurrency exchanges on the planet by buying and selling quantity. It permits customers to purchase and commerce cryptocurrency tokens with fiat currencies and different stablecoins. The Kucoin cryptocurrency trade gives a wealthy suite of buying and selling choices and crypto tokens and is the second-best choice for getting LUNA tokens.

The method of shopping for Terra on Kucoin is fairly much like that on Binance. You want to create an account on the trade, full the identification verification, and choose the asset you want to commerce for Terra.

Suppose you want to purchase and promote LUNA/USDT, then you will want to purchase USDT well worth the quantity you need to spend money on LUNA. You are able to do so by buying USDT by way of fiat deposits along with your debit/bank card or third-party transfers. After getting the specified quantity of USDT in your pockets, place the order for the value you want to purchase the token for. The transaction will undergo inside just a few seconds, and the tokens will mirror in your pockets very quickly.

Storing Your Terra Luna

Whereas crypto exchanges have their very own trade wallets, the chance of cyber-attacks and hacks remains to be excessive when utilizing them. So, it’s extremely beneficial to retailer your cryptocurrency tokens in your personal pockets securely. We distinguish between Software program Wallets (Sizzling Wallets) and {Hardware} Wallets (Chilly Wallets).

Software program Wallets: Software program wallets, often known as Sizzling wallets, are related to the web always. They retailer your keys on-line and are subsequently much less safe. Software program wallets are free to make use of, and their ease of use makes them a super alternative for newbies with just a few tokens. One of the widespread and broadly used software program wallets is the CoinStats Pockets. It’s out there totally free obtain on Google Playstore and App retailer and can present you entry to the complete potential of DeFi and cryptocurrencies.

{Hardware} Wallets: {Hardware} wallets, often known as Chilly Wallets, like Trezor or Ledger, are probably the most dependable choices, as they arrive with protected offline storage and backup options. These are extra appropriate for skilled customers who personal giant quantities of tokens.

Conclusion

Buying and selling cryptocurrencies has proved worthwhile to tens of millions of individuals globally and resulted in making the quickest billionaires and millionaires on the planet. With the facility of DeFi protocols corresponding to Terra, the monetary world is on the cusp of a revolution that goals to remove the necessity for banking and monetary establishments and break their monopoly over the monetary market.

Funding Recommendation Disclaimer: The data contained on this web site is supplied to you solely for informational functions and doesn’t represent a suggestion by CoinStats to purchase, promote, or maintain any safety, monetary product, or instrument talked about within the content material, nor does it represent funding recommendation, monetary recommendation, buying and selling recommendation, or every other sort of recommendation.

Cryptocurrency is a extremely risky market, do your unbiased analysis and solely make investments what you’ll be able to afford to lose. Efficiency is unpredictable, and the previous efficiency of Terra Luna isn’t any assure of its future efficiency.

There are vital dangers concerned in buying and selling CFDs, shares, and cryptocurrencies. Between 74-89% of retail investor accounts lose cash when buying and selling CFDs. It’s best to take into account your individual circumstances and take the time to discover all of your choices earlier than making any funding.

[ad_2]

Source link