[ad_1]

The world of blockchain will get so many new tasks that it’s simple to neglect those that that fizzled out.

Whereas each new “Ethereum killer” will get consideration, as do catastrophe tasks like HashOcean and BAS, it’s vital to look again in time to some older tasks (meaning over 2 years plus, in crypto) that generated enormous hype which by no means translated to outcomes.

—not scams or full failures, however tasks that by no means fairly lived as much as their hype.

By taking a look at these, you’re reminded that in an rising, risky trade like crypto, even massive, highly-anticipated tasks don’t at all times go as deliberate.

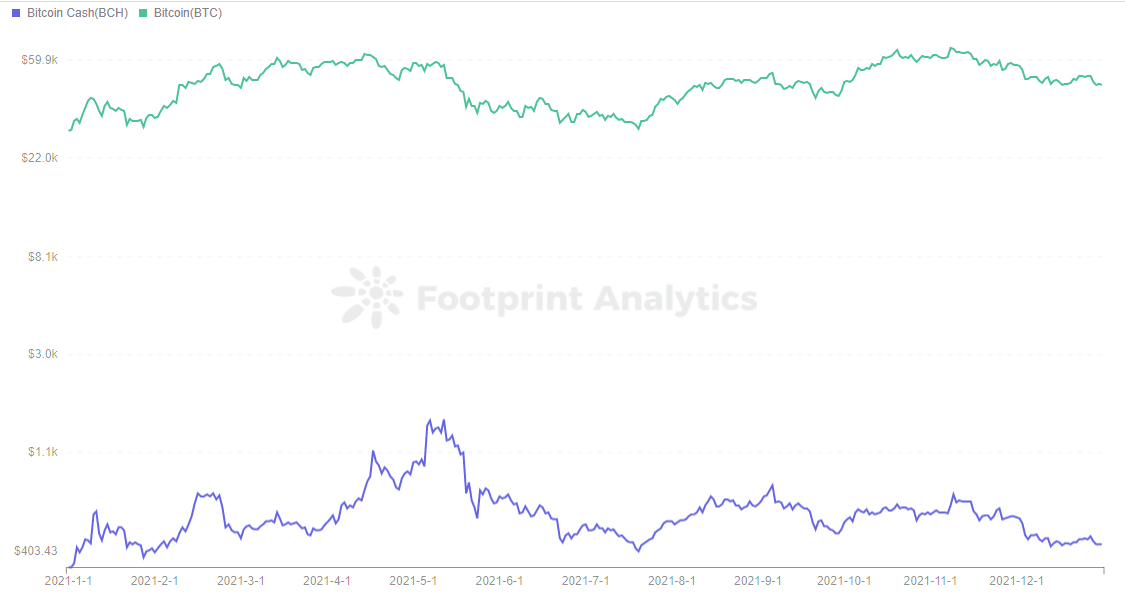

Bitcoin Money

Bitcoin Money, or BCH, is each a fee community and a cryptocurrency. As of March 9, the twenty seventh largest cryptocurrency by market cap. BCH was launched in August 2017 as a tough fork of the Bitcoin blockchain.

It reached an all-time excessive on December 23, 2017, at $3,923. Its value has largely maintained comparable fluctuations to BTC.

Bitcoin Money was forked to extend Bitcoin’s 1M block restrict and has now reached a max of 32M blocks. Subsequently, per transaction processed pace is far larger than BTC, and transaction charges are decrease. However Bitcoin Money can’t beat BTC by way of market cap for now.

Why it didn’t work

BTC continues to be the first crypto for decentralization, cross-border transactions, and continues to evolve as a retailer of worth. It has now turn into analogous to digital gold, with the fee operate fading away.

Digital gold is extra beneficial than a way of fee. BCH is unable to surpass BTC due to its positioning, as iron is lower than beneficial than gold.

BCH was additionally affected by the Fed’s rate of interest hike, steadiness sheet discount, and the autumn of US shares. The very best time to surpass BTC has been missed.

With a brand new bear market on the horizon and unfavorable political elements, there may very well be a brand new wave of downward stress on BTC.

Nonetheless, BCH nonetheless has an energetic neighborhood that believes it might make a rebound and turn into the subsequent large factor, as evidenced by Bitcoin Money’s Reddit neighborhood.

Ethereum Basic

Typically talked about alongside BTC, ETH has its sister, Ethereum Basic. Despite the fact that it’s a community with ETH know-how and BTC idea, it has not shaken Ethereum’s place.

Ethereum’s exhausting fork occurred in July 2016, when founder Vitalik Buterin proposed the concept of a tough fork. To get better the belongings stolen by hackers from the DAO. Ultimately, Ethereum forked into Ethereum and Ethereum Basic.

Ethereum Basic, ETC, is ranked thirty fourth in cryptocurrency market capitalization. The fork retains the imaginative and prescient and philosophy of the unique Ethereum, with the next diploma of decentralization and neighborhood autonomy, however with solely 15% HashRate assist.

These days, each the token value and ecosystem purposes are far lower than Ethereum.

Why it didn’t work

From the exhausting fork, the unique Ethereum founders and group left to go assist and lead the present Ethereum, whereas Ethereum Basic was taken over by a brand new group.

By way of supporters, with 85% HashRate assist after the fork, Ethereum has much more supporters and better demand than Ethereum Basic.

By way of ecosystem integrity, Ethereum has turn into the highest public chain TVL, whereas not many tasks are deployed on Ethereum Basic.

So, in some ways, although Ethereum Basic is extra dedicated and decentralized, it didn’t find yourself being the dominant participant within the blockchain world.

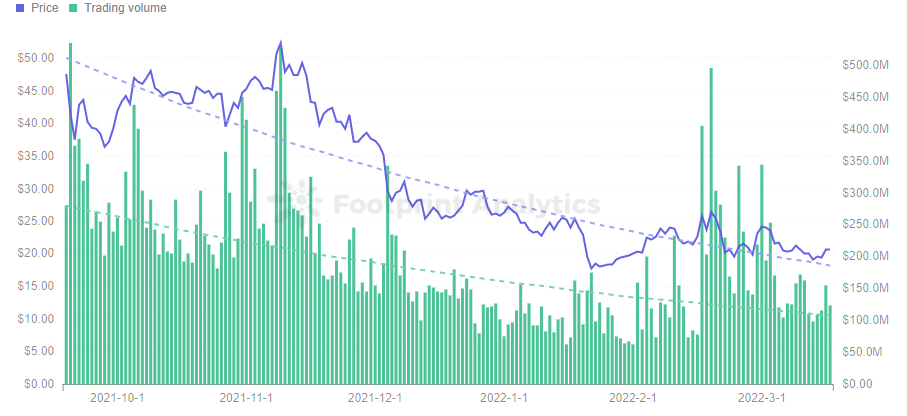

NEO

NEO, previously AntShares, was launched in China in 2014 by Erik Zhan and his group as a public chain. It was an open-source challenge in 2015 on Github and accomplished ICO capitalization just a few months later.

NEO helps the event of its personal cryptocurrency, digital belongings, and good contracts that may obtain 1000’s of transactions per second.

Neo’s value has risen very sharply. From $0.08 at launch, it reached an all-time excessive of $198.38 on January 15, 2018, a rise of two,478.75%.

Nevertheless it was short-lived, and the general downward pattern is obvious in Footprint Analytics information, with the present value at $21.27.

Why it didn’t work

The previous 1,000x coin has fallen, turning into the 77th largest coin by way of market capitalization. This isn’t on account of goal off-site elements such because the poor efficiency of the cryptocurrency market, however quite NEO itself.

- Code updates of NEOs are weak

- Ecosystem growth is nearly stagnant.

- Decentralization is weak. There are solely 7 voting nodes and they’re formally deployed by NEO.

Because the saying goes, if the muse shouldn’t be sturdy, the bottom will shake. If NEO fails to deal with the above points, it’s going to proceed to be overtaken in a brand new bear market.

EOS

In Might 2017, block. one launched EOS as a sensible contract platform and distributed working system. It turned a powerful competitor to Ethereum in 2018.

At the moment, the market was skeptical of Ethereum on account of transaction congestion, excessive fuel charges, and failure to launch its sharding know-how.

After launching in lower than 6 months, EOS—with zero charges and very quick transaction speeds—crashed Ethereum’s lower than 3,000 every day transactions with a single-day depend of 30,000. EOS was the OG Ethereum-killer.

Why it didn’t work

Nonetheless, the younger protocol finally didn’t reside as much as its potential. EOS’s extraordinarily quick transaction processing comes on the expense of decentralization.

EOS’s consensus mechanism has 21 supernodes to course of transactions, making it inconceivable for smaller node operators to take part. Supernodes are elected by holding cash, with the implied danger of bribery.

Ethereum and Bitcoin’s POW consensus mechanism is inefficient, whereas EOS’s Delegated Proof of Stake (DPoS) consensus mechanism may be very environment friendly.

But, the core of blockchain is decentralization, and EOS is actually extra of a centralized chain.

Presently, virtually all energetic high public chains have spectacular purposes or at the least have protocols that assist public chains. For instance, Anchor on the Terra chain. Nonetheless, EOS didn’t.

Though EOS officers have repeatedly stated that they assist ecosystem building, as of March 9, the on-chain ecosystem of EOS nonetheless appears to be like like a barren wasteland.

Dfinity/Web Laptop

Dfinity is a decentralized cloud know-how platform. Based in 2016, it was fairly standard with enterprise capitalists. It bucked the bear market in 2018 and obtained $102 million in funding from a16z, the most important outbound funding by a16z that 12 months.

Dfinity’s imaginative and prescient is to create a public cloud computing platform that’s extra environment friendly and safe than AWS, placing the blockchain community underneath the management of a distributed laptop community.

The Web Laptop was anticipated to launch within the second half of 2018 or the primary half of 2019, however the precise Alpha grasp community went reside in December 2020.

Why it didn’t work

Dfinity has taken greater than two years since its funding to ship a product and it’s not distinctive. The group strikes too slowly.

By way of blockchain AWS options, Alchemy, a blockchain growth platform service for Web3, was based in 2017 and powers many of the world’s blockchain firms right this moment.

For supply code, Github has been round since 2008 and is the platform the place the overwhelming majority of right this moment’s blockchain protocols are hosted.

Neighborhood autonomy, which permits the neighborhood to handle tokens, has additionally been applied in lots of tasks.

Whereas the idea of Dfinity is attention-grabbing, the delayed launch precipitated the challenge to lose its thunder.

Date & Creator: March 29 2022, Grace

Information Supply: Footprint Analytics

This piece is contributed by the Footprint Analytics neighborhood.

The Footprint Neighborhood is a spot the place information and crypto fans worldwide assist one another perceive and achieve insights about Web3, the metaverse, DeFi, GameFi, or every other space of the fledgling world of blockchain. Right here you’ll discover energetic, numerous voices supporting one another and driving the neighborhood ahead.

What’s Footprint Analytics?

Footprint Analytics is an all-in-one evaluation platform to visualise blockchain information and uncover insights. It cleans and integrates on-chain information so customers of any expertise degree can rapidly begin researching tokens, tasks, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anybody can construct their very own personalized charts in minutes. Uncover blockchain information and make investments smarter with Footprint.

Get your every day recap of Bitcoin, DeFi, NFT and Web3 information from CryptoSlate

It is free and you’ll unsubscribe anytime.

Get an Edge on the Crypto Market 👇

Develop into a member of CryptoSlate Edge and entry our unique Discord neighborhood, extra unique content material and evaluation.

On-chain evaluation

Worth snapshots

Extra context

Be part of now for $19/month Discover all advantages

[ad_2]

Source link