[ad_1]

The beneath is from a current version of the Deep Dive, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

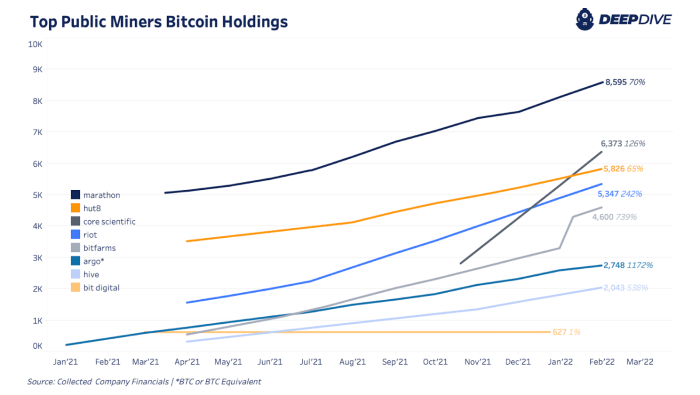

January was yet one more optimistic “up and to the fitting” sort of month for the highest publicly-traded miners throughout their bitcoin holdings and their hash charge. This group of eight miners now maintain 36,159 bitcoin, up 12.35% from December 2021. Within the charts beneath, we gather reported figures from firm financials, month-to-month manufacturing updates, investor displays, and press releases when obtainable.

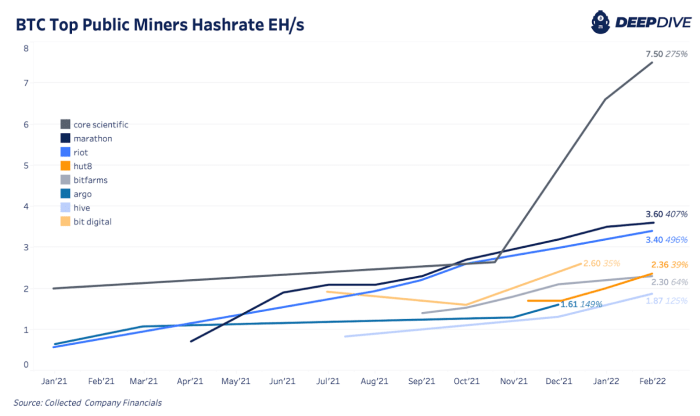

Like bitcoin holdings, hash charge capability continues to develop throughout all miners. The most important month-over-month change in hash charge got here from Core Scientific growing to 7.5 EH/s from 6.6 EH/s in December. Present hash charge is 2.84x from the two.64 EH/s they’d in October 2021. They now lead public bitcoin miners in hash charge capability.

That hash charge contains a 75,000-machine fleet of top-tier ASICs that produced over 1,000 bitcoin for the month. In 2022, Core Scientific has roughly 90,000 extra machines beneath contract for supply.

Buying and selling beneath the ticker, $CORZ, Core Scientific went public final month on the Nasdaq. It at the moment has a market capitalization of $3.6 billion which makes it the most important public miner in the marketplace. Marathon’s market capitalization is at the moment $2.84 billion. As most mining shares are, Core Scientific is very correlated with bitcoin with a 14-day rolling correlation coefficient of 0.74.

[ad_2]

Source link